hi all

i am not the best writer of them all would just like to make everyone ordering from abroad aware of same points.

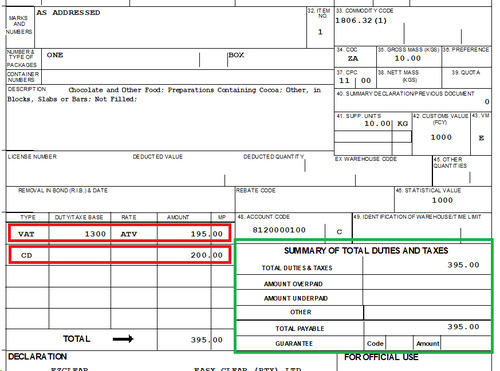

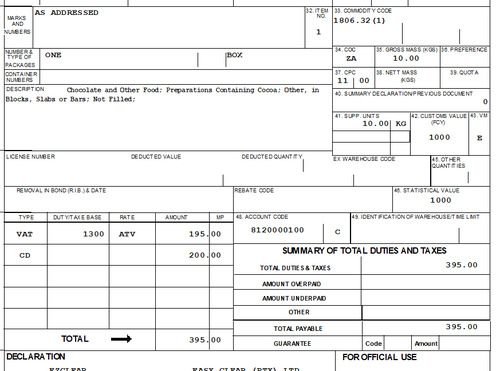

1: who ever you are ordering from make them send the correct invoice with your goods. as they send a fake one of low value and can get you a fine wen customs looks at it

2: track your shipment online if you see it gets on a plain to sa. phone the shipping company and mail them the invoice you got. say in mail i declare this is what i am bringing in.

3: yes you will get tax but its a lot less then a big penalty and keep it small i think under r3500 don't pay tax as well ( will be testing this soon)

hope this helps

i am not the best writer of them all would just like to make everyone ordering from abroad aware of same points.

1: who ever you are ordering from make them send the correct invoice with your goods. as they send a fake one of low value and can get you a fine wen customs looks at it

2: track your shipment online if you see it gets on a plain to sa. phone the shipping company and mail them the invoice you got. say in mail i declare this is what i am bringing in.

3: yes you will get tax but its a lot less then a big penalty and keep it small i think under r3500 don't pay tax as well ( will be testing this soon)

hope this helps