I do understand that, normally whatever was initially proposed will end up on that corrupt bill eventually.That was the proposal. The final amendment was different.

Just my thoughts, I was proven right before so let's hope this time I'm wrong.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: this_feature_currently_requires_accessing_site_using_safari

I do understand that, normally whatever was initially proposed will end up on that corrupt bill eventually.That was the proposal. The final amendment was different.

Meanwhile in the UK

UK pushes vapes in world first 'swop-to-stop' campaign - Juta MedicalBrief

British authorities will go all out to encourage about 1m smokers to swop cigarettes for vapes, with pregnant women offered financial incentives to make the change in what will be a world first, the government said this week. Under the scheme, almost one in five smokers will be given an...www.medicalbrief.co.za

Have you calculated how much nicotine you would need?I DIY, so I'll just stock up on a shitload of nicotine. F*** them.

I see your reasoning,but nowhere doesn't it say any different. In a country where corruption is the order of the day... Nicotine content is still nicotine content doesn't matter the container.

"View attachment 271825

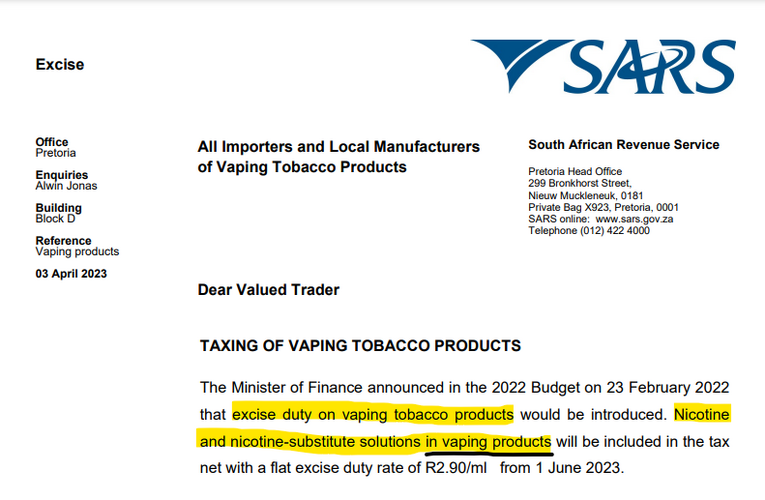

Check the proposal... It says" nicotine and non nicotine solutions"

So Im all for giving them the benefit of the doubt, but all that been happening eversince I can remember is when the doubt becomes real, there is no benefit.

Remember nicotine is also still part of the import /export trade.

I might be wrong in everything I said so if I am I'm apologizing now already.

Reached out to some contacts and got this back already:

"Hi

Thanks for reaching out to us

As it stands, DIY seems to be unaffected. Meaning that, yes, you are correct. Nicotine on its own cannot be vaped so it is not a vaping product.

However, we are currently monitoring the situation and reviewing the information available in order to determine the full effect of the tax."

Vaping makes up less than 1% of total VG use in South Africa. I know this as Geoff from Clyrolinx used to import VG for a company before he went on his own and the amounts he brought in was staggering. So the chances of them taxing that, at that rate, is not something I am lying awake over at the moment.If thats how they will argue what can be taxed and what not, I guess next they will want tax for just VG, that can be vaped by itself

Vaping makes up less than 1% of total VG use in South Africa. I know this as Geoff from Clyrolinx used to import VG for a company before he went on his own and the amounts he brought in was staggering. So the chances of them taxing that, at that rate, is not something I am lying awake over at the moment.

No idea to be honest. I do not think it falls into the realm though because they very specifically state "nicotine and nicotine substitute".Will this affect CBD products at all?

Might be another loophole. Can always do what they did in lockdown. Add a insignificant amount of CBD and say it's for "medical purposes". Sell a 10 ml bottle of nic on the side to mix in. Can save a rand maybe.No idea to be honest. I do not think it falls into the realm though because they very specifically state "nicotine and nicotine substitute".

If it is in vape juice it will fall under this act for sure.Might be another loophole. Can always do what they did in lockdown. Add a insignificant amount of CBD and say it's for "medical purposes". Sell a 10 ml bottle of nic on the side to mix in. Can save a rand maybe.

I thought as much. Wondered when that part would come out of hiding.Reached out to some contacts and got this back already:

"Hi

Thanks for reaching out to us

As it stands, DIY seems to be unaffected. Meaning that, yes, you are correct. Nicotine on its own cannot be vaped so it is not a vaping product.

However, we are currently monitoring the situation and reviewing the information available in order to determine the full effect of the tax."

I don't care. I'll take out a loan just to buy nicotine and will stock up. Again, f... them....lolHave you calculated how much nicotine you would need?

Take myself for example, I vape about (rounding up and adding a small bit for stressed times) 150ml per week. 150ml @ 3mg is 4.5ml nic per week. 52 weeks per year makes it 234ml. Not too bad. Now let's say I have another 30 years ahead of me (not that nicotine would last that long but that's a different argument) that would then be 7 Litres. On quick glance cheapest I could find per 500ml is Flavourworld who offers their CBE nic, 100ml 500ml, at R750. R750 x 7 is R5250. That's quite an investment amount on very short notice. Alas, I will not keep nicotine for longer two years at absolute maximum (so one bottle should technically be fine) and even then I'd store it in my freezer, so eventually I will have to pay this new exorbitant tax of theirs.

With that tax, that little 500ml bottle will now cost R2200....

Crude language out and about on the forum is frowned upon no matter how deserved it is but I promise you I share your sentiments about the honourable persons!!Vaping is adults only.

What are the forum rules? Can I vent here and direct crude language at the honourable persons behind this tax business?

Crude language out and about on the forum is frowned upon no matter how deserved it is but I promise you I share your sentiments about the honourable persons!!

Alas not, Google has search engines and everything is publicly viewable globally.Vaping is adults only.

What are the forum rules? Can I vent here and direct crude language at the honourable persons behind this tax business?

@admin Is it possible to move the above threads about vape tax (from #1341) to this thread https://www.ecigssa.co.za/threads/vape-tax-from-1-june-2023.78311/#post-990406, so that all discussions re vape tax can be in one thread?

This is why vape eliquid manufacturers have to apply for a license. And the tax will be applied to any sales they make. So the components up to that point are not taxed but once it becomes part of a manufactured product, a eliquid for vaping, then it will carry the new tax. Just like eggs, flour, oil, etc. are not taxed but as soon as you bake a cake from it, then it would carry a sugar tax.How exactly do SARS propose to implement this tax, when all the components of eliquid are used for purposes other than eliquid, and;

At what point in the manufacture chain, does juice as we know it, become; "a nicotine or nicotine substitute for a vaping product", as SARS refer to it?